“Every Year BILLIONS in property taxes go delinquent. This NEW SOFTWARE allows you to invest in those properties from home without going to county offices or ever worrying about renovations...”

The All-In-One System to Finding, Funding & Cashing-In On Your First Tax Default Property...

Simple Step-by-Step System

- Find deals as they are listed on state databases. Get there first... before other investors.

- The same type of software used by top wall street investors for a fraction of the cost.

- See all information on properties: including photos, price, zoning and more. All in ONE place.

-

Invest in tax liens from anywhere in the world. Easy as point, click and buy!

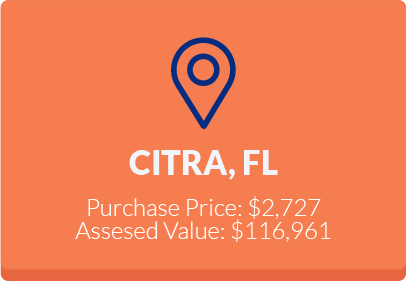

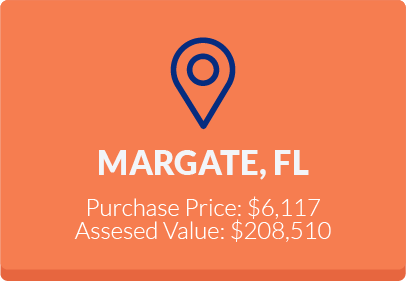

People All Over The Country Are Taking Advantage of This Little Known, 200 Year Old Investment Source:

Lucy Pederson

She acquired land in North Port Florida, (Sarasota County) for about $4,400. The property had an assessed value of $4,000 and she found a buyer that was a nearby property owner for $9,000 two weeks after she acquired it and closed on it a month later.

Michael W., Texas

Bought a deed in OH for $24,000. The house was occupied but in rough shape. He offered the current tenants $1,200 to move out within 2 weeks and they left without further damaging the property. He’s been in the midst of the rehab since about March/April and close to finishing up. He’s spent about $50,000 in rehab so far. ARV is around $115,000. Profit roughly $30,000 to $35,000 after any additional expenses and closing costs are paid.

Ivan Mesa

Jay Drexel

Hi, my name is Jay Drexel!

Over 10 years ago, I was broke and a single dad. My house went into foreclosure and I had to move into my Mom’s basement with my son. I knew had to change something.

That’s when I discovered Tax Default Property Investing… Fast forward to today I have over 700 Tax Default Investments, and I buy a couple every single week from my home office.

These investments are in multiple states, they are making anywhere from 10% to 25% ROI. I’m a full time investor and educator. As you might imagine, this type of investing has changed tremendously over the years.

You no longer have to travel to tax sales to compete with billion dollar investors... You no longer have to spend hours calling county offices or driving around neighborhoods trying to find safe invests. Now, with the right education and technology, you can invest safely and successfully from the comfort of home… with as little as $20… making your money work for you.

Jay owns over 700 Tax Default investments and now he shows people how to do the same!

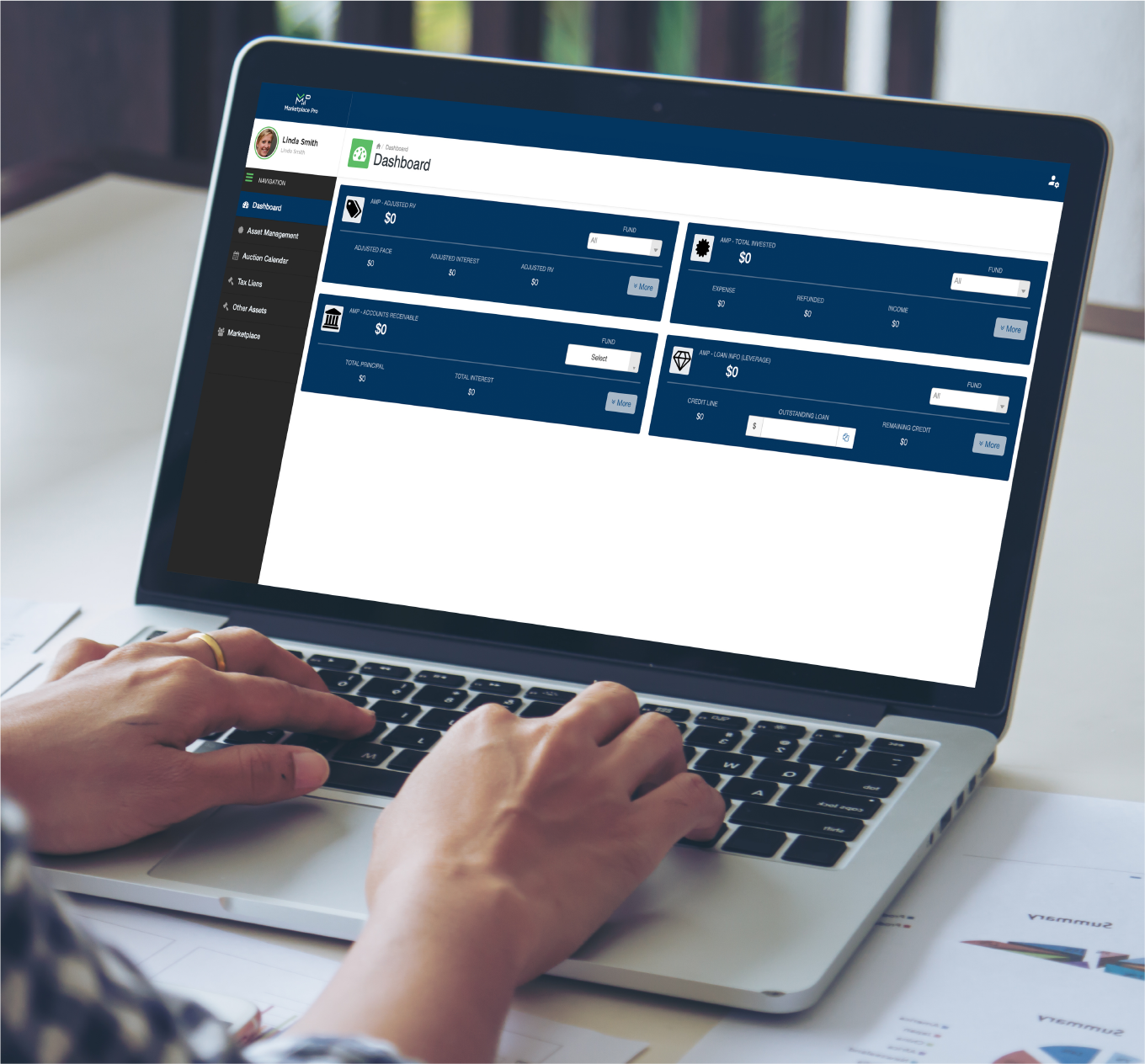

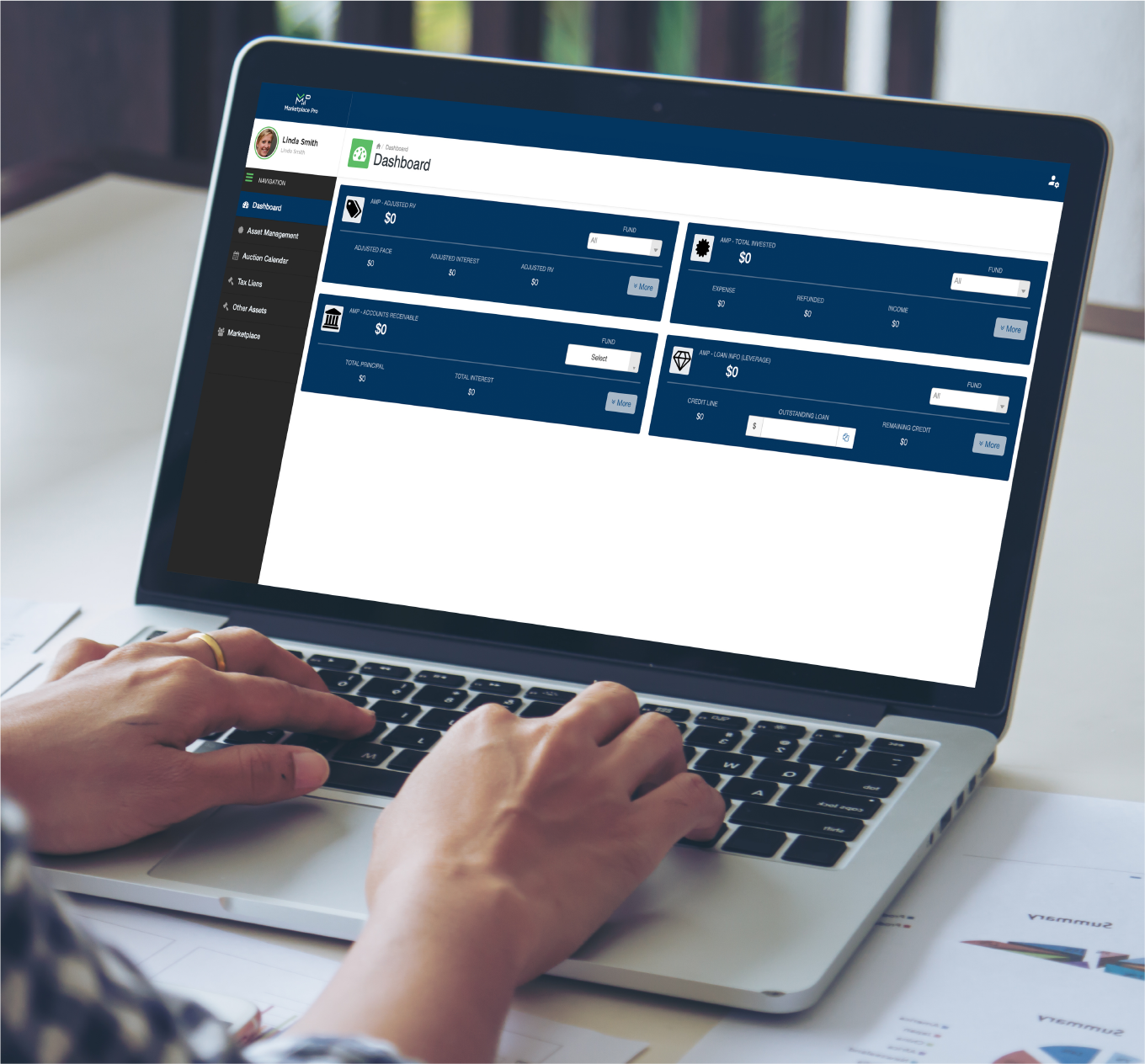

Introducing Marketplace PRO

The First Publicly Available Tax Lien Software That Let's You

Find And Buy Tax Liens From Anywhere In The World

After much anticipation, Marketplace Pro has finally been released!

Is Now A Good Time To Invest In Real Estate ?

Buying Liens is one of the smartest and safest moves you can make right now.

Consider this:

- Real estate is the most foundational asset you can own.

-

It's the most historical and in demand asset in existence.

-

Tax Liens are the LOWEST barrier to entry for real estate. Meaning investing in Tax Liens and deeds on homes are the fastest and easiest way to invest....

- Marketplace Pro Software allows user to skip all the major and typical Real Estate investing "pains in the butt".

No More

The Difference Marketplace Pro Makes is Night and Day

When you experience it for yourself, we trust that you’ll stay subscribed...Marketplace Pro is just that good!

- For a limited time, we are opening Marketplace Pro for other investors to use!

- See for yourself and be amazed by the power this system offers.

- Use Marketplace Pro without limitations for a full 30 days.

-

That’s enough time to fully complete multiple tax lien deals.

Lien and Deed investing allows you to potentially profit in one of two ways:

And We Prepared For It - By Creating Marketplace Pro

Software

It allows you to BUY liens right there in the software!

It allows you to BUY liens right there in the software!

- Just look, click and buy. Then sit back and collect checks with interest from the country.

Andy S.

"Love your straightforward, no B.S approach to real estate investing, I've attached the 4 properties I have invested in for you to review. A net return of 22% on 11 properties! Thanks again."

Judy P.

"I have been to many of the seminars and bought all of the real estate courses so I was skeptical about Marketplace Pro. I was also hesitant about investing in a different area from where I live. But the software is super simple, if you can check your email you can use it! The advisor call was super helpful, talking me through the entire process. I now own tax lien certificates on 7 properties!. The staff has been great and very professional.”

Jared S.

“Marketplace Pro is a complete game changer. I used to fix and flip properties but it was a BIG headache. Now that I am investing in tax defaulted , I skipped all those pain in the butt renovations and delays by contractors. I just grab the lien online and get checks from the county. This is as passive as it gets!”

Looking for a Membership walkthrough?

Please call and we'll take you through the ins and outs of the

Marketplace Pro Software!

833-825-6800

Marketplace Pro Software!

833-825-6800

833-825-6800

8545 W. Warm Springs Rd

STE A-4 #334

Las Vegas, NV 89113

Phone: 833-825-6800

support@marketplacepro.net

Copyright © 2021-2022 Marketplace Pro. All Rights Reserved.

A division of GREI Training, LLC

This website is a promotion. This is NOT endorsed by Facebook in any way.

Individual results may vary. It depends on the time, energy, knowledge and money an individual puts into their real estate business. We provide real estate, tax & entity education. We do not provide accounting or legal advice nor do we prepare tax returns or entity structuring. We make no earning or return on investment claims or guarantees. Prior to undertaking any business transaction, you may want to consult your own accounting, legal or tax advisor.